The ultimate banking app solution, where advanced security meets all-encompassing financial solutions. Your final stop for a safe, seamless, and sophisticated banking experience.

Banking Software Development Solutions

Webevis Technologies is dedicated to developing cutting-edge banking software solutions to meet the changing needs of the financial industry. Our expert team creates reliable digital banking solutions, efficient phone banking software, and customized banking software development services. With a focus on security, scalability, and user experience, we help banks streamline operations, improve customer engagement, and stay competitive in the financial landscape.

Benefits

Opting for a ready-to-launch digital banking app like ours offers specific and substantial benefits:

Personalize with your brand name and launch within just 2 to 3 weeks, offering a swift entry into the digital banking space.

Benefit from cutting-edge technology that ensures a robust, secure, and efficient banking experience.

Since the app is pre-built, you save significantly on development costs, making it a financially prudent choice.

Enjoy an attractive and intuitive user interface designed for ease of use, enhancing customer satisfaction.

Streamline banking operations for your users, saving them time with efficient transaction processing and account management.

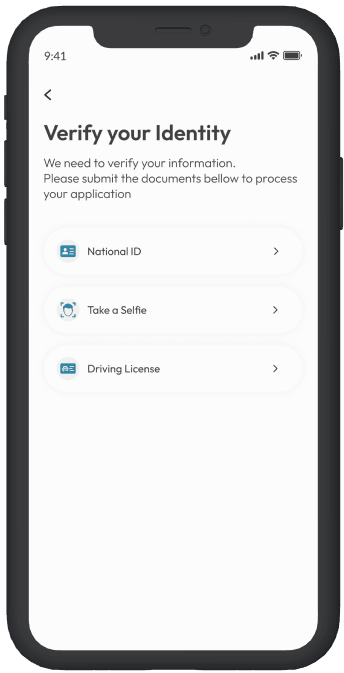

Stand out with a sophisticated Know Your Customer (KYC) verification process, offering an additional layer of security and compliance that many standard banking apps lack.

Banking Software Solutions We Provide

Webevis Technologies is at the forefront of delivering innovative banking software solutions that improve customer experiences and operational efficiency. Our expert team works closely with financial institutions to implement cutting-edge technologies that increase operational efficiency, improve the customer experience, and drive business growth.

The following are a few of the banking software solutions we can develop:

● Internet Banking: We create secure and user-friendly internet banking platforms that allow customers to manage their accounts, transfer funds, and conduct transactions all online.

● Mobile Banking: Our mobile banking solutions enable customers to access banking services at any time and from any location using intuitive and feature-rich mobile applications.

● Customer Portal: We design and build customer portals that provide personalized banking experiences, allowing users to easily access account information, track transactions, and interact with banking services.

● Banking CRM: Our CRM solutions help banks strengthen their customer relationships by capturing and analyzing customer data, facilitating targeted marketing campaigns, and providing personalized services.

● Loyalty Program Management: We create loyalty program management software to assist banks in rewarding customer loyalty, increasing engagement, and driving customer retention.

● Banking Data Analytics: Our advanced analytics solutions provide banks with valuable insights into customer behavior, market trends, and operational performance, allowing them to make more informed decisions and plan more strategically.

● Lending Software: We provide customizable lending software solutions that simplify the loan origination process, automate credit risk assessment, and improve loan portfolio management.

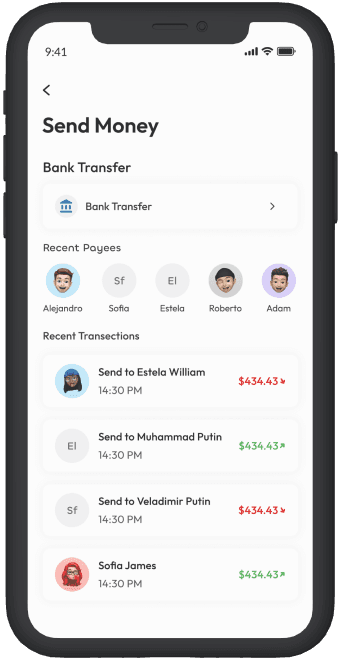

● Payment Software: Our payment software solutions enable secure and efficient payment processing for online payments, card transactions, and mobile wallets.

● Facial Recognition Software: We incorporate facial recognition technology into banking systems to improve security, simplify authentication processes, and prevent fraud.

Banking IT Services We Offer

Our holistic approach to transforming banking operations through a range of IT services goes beyond simply providing banking software solutions. We collaborate closely with financial institutions to understand their unique challenges and devise tailored strategies for leveraging technology to drive innovation, enhance customer experience, and achieve sustainable growth.

● Digital Transformation Consulting

Our digital transformation consulting services guide banks through the complex process of embracing digital technologies to modernize their operations, optimize processes, and unlock new opportunities for growth. We support our clients in confidently and clearly navigating the digital landscape, from strategy development to implementation.

● IT-Based Customer Experience Consulting

With our customer experience consulting services, banks can reimagine and elevate the customer journey by leveraging technology to provide seamless, personalized experiences across all touchpoints. Our services, which range from omnichannel integration to user interface design, enable banks to surpass client expectations and create enduring bonds.

● Solution Implementation

Our expertise in banking software development enables us to seamlessly implement cutting-edge solutions tailored to the specific needs of each client. We guarantee a seamless transition and the least amount of disturbance to business operations when implementing mobile applications, internet banking platforms, or sophisticated analytics systems.

● Solution Maintenance and Support

Our dedicated support team provides ongoing maintenance and support services to ensure that banking IT solutions run smoothly by proactively addressing issues, implementing updates, and optimizing performance to meet changing business needs and regulatory requirements.

Addressing Banking Challenges with Tailored Software Solutions

Financial institutions face numerous challenges that can stifle growth, erode customer trust, and reduce competitiveness. Webevis Technologies understands the industry's complexities and provides tailored software solutions to tackle these pressing business challenges head on, allowing banks to thrive in an increasingly competitive environment.

This is how we address a few typical banking challenges:

● Decreased Level of Customer Trust

Building and maintaining customer trust is critical in this day and age of data breaches and cybersecurity threats. Our banking software solutions include strong security measures and encryption protocols to protect sensitive data, restoring confidence in your brand.

● Customer Attrition

With increased competition from traditional banks and fintech disruptors, customer retention has become a significant challenge. Our digital banking solutions prioritize the customer experience, providing intuitive interfaces, personalized services, and seamless omnichannel interactions to reduce churn and foster loyalty.

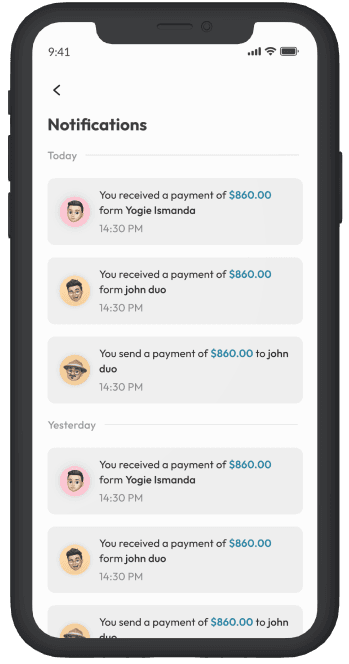

● Disintegrated Communication with Customers

Fragmented communication channels can lead to customer frustration and dissatisfaction. Our integrated banking software solutions centralize communication channels, allowing consistent and coordinated interactions across all touchpoints, including email, SMS, in-app messaging, and social media platforms.

● Fragmented View of Customers

Siloed data and disparate systems can result in a fragmented view of customers, impeding personalized service delivery and targeted marketing. Our banking software development services integrate multiple data sources and use advanced analytics tools to provide a unified view of customers, allowing for tailored offerings and targeted campaigns.

● Increased Competition from Fintechs and More

The emergence of fintech startups and non-traditional competitors poses a significant threat to traditional banks. Our innovative banking software solutions empower institutions to adapt to changing market dynamics, innovate rapidly, and stay ahead of the competition through agility, flexibility, and customer-centricity.

● Unsatisfactory CX and Loyalty

Poor customer experiences can damage a brand's reputation and reduce customer loyalty. Our digital banking solutions aim to improve every aspect of the customer journey, from account creation to ongoing support, in order to provide exceptional experiences that foster loyalty and advocacy.

● Weak Cross-Selling

Ineffective cross-selling strategies can result in missed revenue opportunities and underutilized customer relationships. Our banking software solutions leverage data-driven insights and predictive analytics to identify cross-selling opportunities, personalized product recommendations, and optimize sales processes, driving revenue growth and profitability.

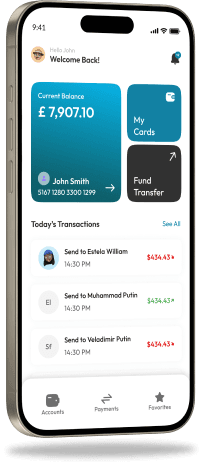

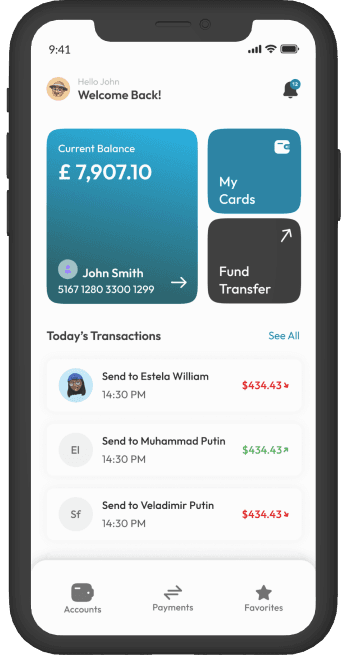

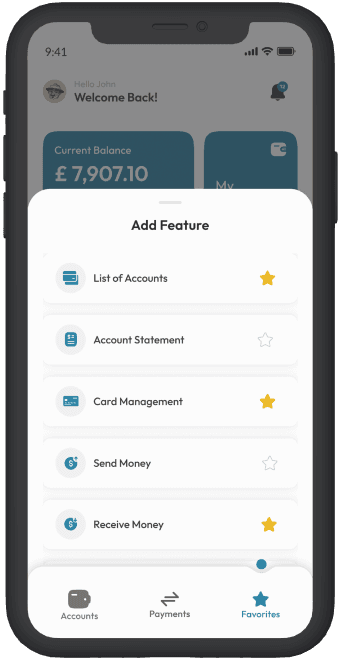

Key Features of Our Digital Banking Solution

Webevis Technologies provides digital banking solutions with advanced features to meet the changing needs of modern financial institutions and their customers. Our digital banking solution includes the following key features:

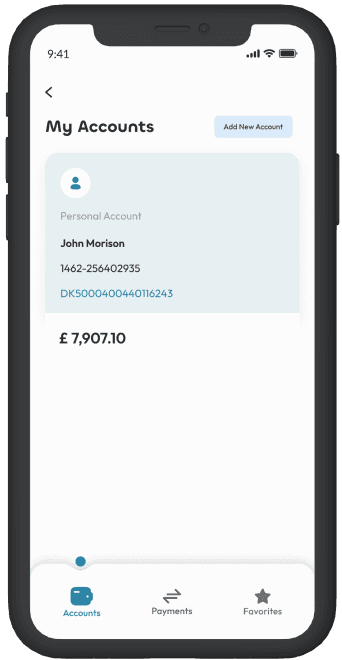

● Personal Online Banking

Our digital banking solution offers a personalized online banking experience, allowing customers to manage their accounts, transfer funds, and access a range of financial services conveniently from any device, anytime, anywhere.

● Flexible Reporting

With flexible reporting capabilities, our solution empowers users to generate custom reports tailored to their specific needs, providing valuable insights into account activity, spending patterns, and financial trends.

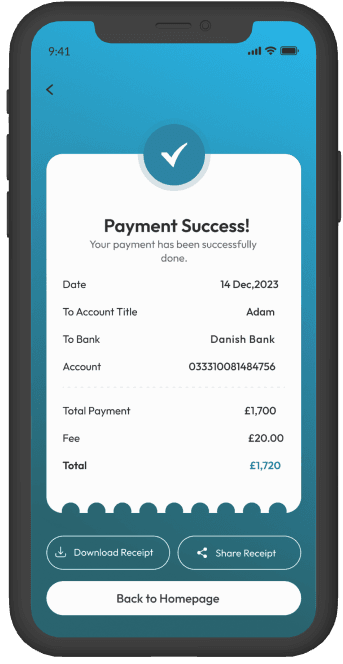

● Powerful Bill Payment

Simplify bill payment processes with our powerful bill payment feature, enabling users to securely pay bills, schedule payments, and manage payees effortlessly within the digital banking platform.

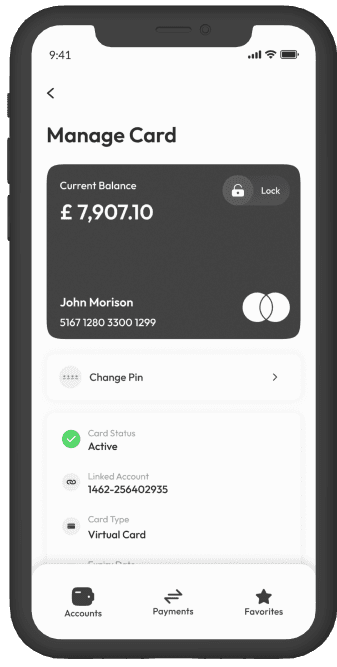

● Multi-Layer Security

Our solution incorporates multi-layer security measures, including encryption, two-factor authentication, and transaction monitoring, to safeguard customer data and prevent unauthorized access or fraud.

● Easy to Use

Our digital banking solution is designed with a focus on simplicity and intuitiveness, ensuring that users of all levels of technical proficiency can navigate the platform with ease and confidence.

● Positive Pay

Mitigate the risk of check fraud with our positive pay feature, which allows businesses to submit check issuance information electronically, enabling banks to match incoming checks against authorized transactions and flag suspicious items for further review.

Interested in learning how our digital banking solution can address your specific needs and challenges? Request a consultation with our experts to discuss tailored solutions and explore new opportunities for growth and innovation.

FAQs

What is Digital banking app?

A digital banking app is a software application that enables users to access and manage their bank accounts and financial services through digital devices like smartphones, tablets, or computers. These apps are typically developed by banks, financial institutions, or fintech companies and offer a wide range of features that replicate or expand upon the services available at traditional bank branches.

How quickly can Digital banking app be launched with my brand name?

Digital banking app can be customized with your brand name and ready to launch in just 2 to 3 weeks.

What makes Digital banking app's technology advanced?

Digital banking app uses state-of-the-art technology to ensure secure, efficient, and reliable banking operations. This includes advanced encryption, biometric security, and an intuitive user interface.

Will I incur additional development costs with Digital banking app?

No, Digital banking app is a pre-built solution, which means you won't have to pay extra for development charges, making it a cost-effective option.

How user-friendly is the Digital banking app?

The app boasts an attractive, intuitive interface, making it easy for users of all technological backgrounds to navigate and manage their finances.

What kind of security features does Digital banking app have?

Digital banking app employs robust security measures including KYC verification, multi-factor authentication, and encrypted data protection to ensure user safety and compliance.

Does Digital banking app offer any unique features compared to other banking apps?

Yes, Digital banking app's unique selling point is its enhanced KYC verification process, which provides an added layer of security not commonly found in standard banking apps.

Can I integrate Digital banking app with other financial tools?

Digital banking app is designed for compatibility and can be integrated with various financial tools and services to enhance its functionality.

Is there customer support available for Digital banking app users?

Yes, Digital banking app offers comprehensive customer support through various channels like in-app chat, email, and phone.

How does Digital banking app help in managing personal finances?

The app includes features like budgeting tools, expense tracking, and financial insights, aiding users in effective financial management.

This website stores cookies on your computer. These cookies are used to improve your website experience and provide more personalized services to you, both on this website and through other media. To find out more about the cookies we use, see our privacy policy.