This website stores cookies on your computer. These cookies are used to improve your website experience and provide more personalized services to you, both on this website and through other media. To find out more about the cookies we use, see our privacy policy.

- Company

- ServicesWeb Development

Web App Development

UI/UX Designing

PSD To HTML

Devops

Ecommerce

WordPress Development

Graphic Designing

AI Development

- Case Studies

- Solutions

- Expert Pool

Company

Services

Services

Case Studies

Case Studies

Fintech

AI Platforms

Solutions

Expert Pool

Expert Pool

Mobile Developer

Designer

Management

Quality Assurance

Customer Support

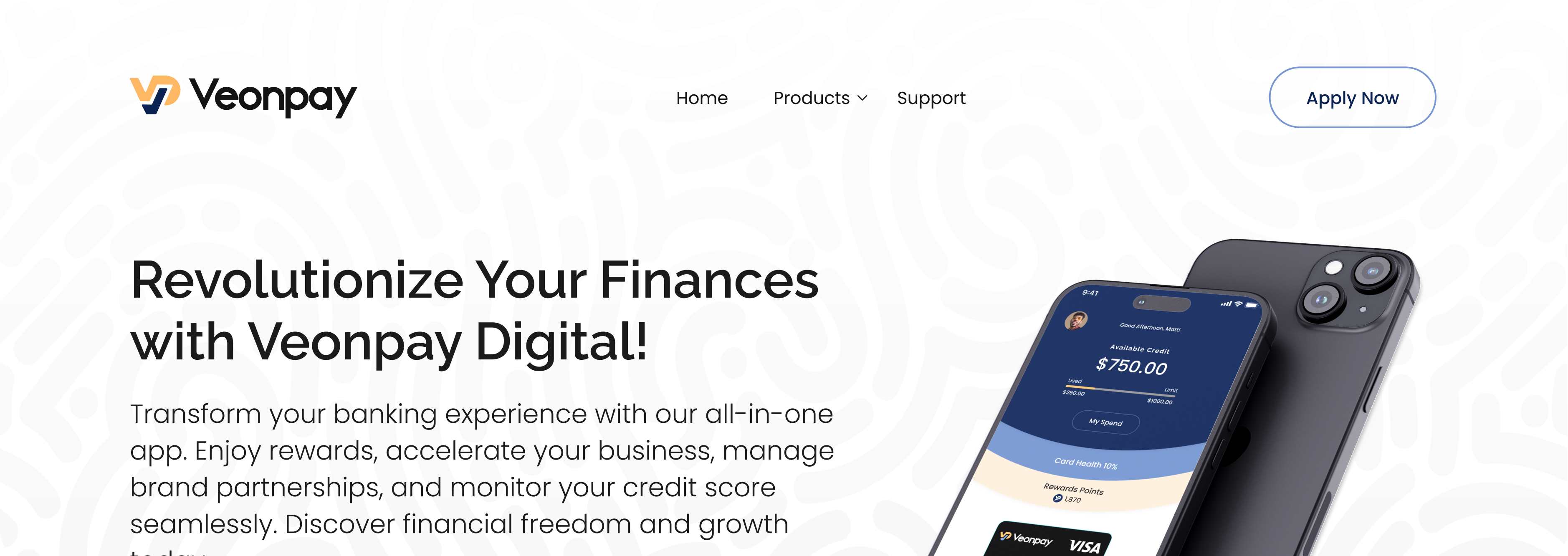

VeonPay

Digital banking application and reward platform

2024

Scroll

Client

Industry

Digital Banking & Financial Service

Headquarters

Global / Web3 Project

Services

Design & Development

AE

Level 01, Innovation One

DIFC Dubai

US

600 N board street

suit 5# 3260 middletown DE

19709

UK

18-B, 13 Northfield

place Bradford

BDB 8AE

PK

65L Gulberg

2, Lahore, Punjab

54660

Get Latest Updates

© Copyright 2025 by Webevis Technologies